Market Structure

Financial markets are where people buy and sell assets like stocks, bonds, and currencies. Financial markets are also like marketplaces where money is traded. They help people, businesses, and governments raise funds, invest, and manage risks. These markets can be divided into different types based on what they trade, how long the investments last, and who participates. Let’s break them down in an easy-to-understand way.

The Reserve Bank of India (RBI), which was established by an Act in 1935, regulates India’s banking sector. In India, the Reserve Bank of India (RBI) serves as both a monetary authority and a bank supervisor.

Structure of Financial Markets

1. Types of Financial Markets

A. Money Market (Short-Term)

- Deals with borrowing and lending for less than one year.

- Used by banks, companies, and governments for quick cash needs.

- Examples:

- Treasury Bills (T-Bills) – Short-term govt. debt (14 days to 1 year).

- Commercial Paper – Unsecured loans taken by big companies.

- Certificates of Deposit (CDs) – Banks issue these for fixed-term deposits.

B. Capital Market (Long-Term)

- Deals with investments for more than one year.

- Helps companies raise funds for expansion.

- Two main parts:

- Stock Market (Equity Market) – Where shares of companies are traded (e.g., NSE, BSE).

- Bond Market (Debt Market) – Where govt. and companies raise loans through bonds.

2. Primary Market vs. Secondary Market

A. Primary Market (New Issues)

- Companies raise fresh capital here by selling shares or bonds for the first time.

- Example: IPO (Initial Public Offering) – When a company lists on the stock exchange.

B. Secondary Market (Trading Market)

- Investors buy and sell existing stocks/bonds among themselves.

- Provides liquidity—you can sell your investments anytime.

- Example: Buying shares of Reliance or TATA on NSE/BSE.

3. Organized vs. Unorganized Markets

A. Organized Market (Regulated)

- Follows strict rules set by regulators like RBI, SEBI.

- Examples: Stock exchanges, banks, mutual funds.

B. Unorganized Market (Informal)

- No strict regulations (higher risk).

- Examples: Local moneylenders, private lending.

4. Other Key Financial Markets

A. Foreign Exchange (Forex) Market

- Where currencies are traded (e.g., USD to INR).

- Helps businesses and travelers exchange money.

B. Commodity Market

- Trading of raw materials like gold, oil, wheat.

- Farmers and industries use it to hedge price risks.

C. Derivatives Market

- Deals with contracts based on future prices of assets.

- Used for hedging (risk management) or speculation.

- Examples: Futures, Options.

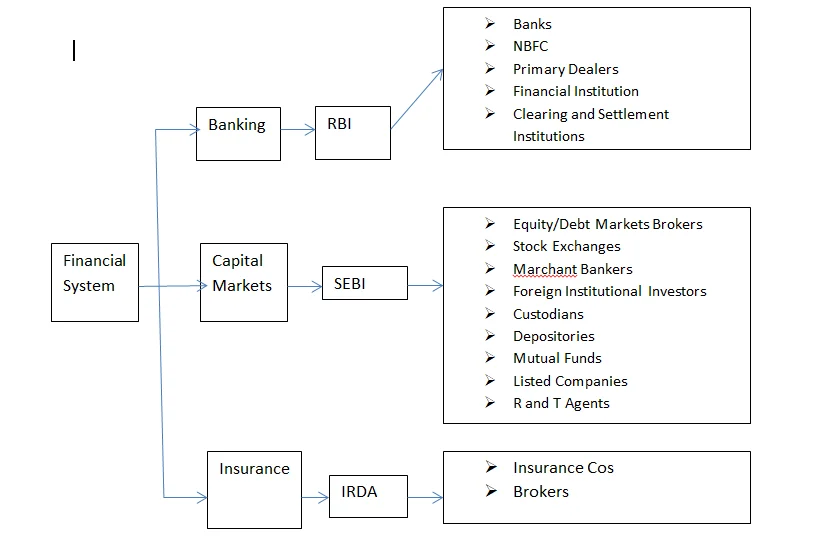

5. Role of Regulators

Financial markets need supervision to prevent fraud and ensure stability.

- RBI (Reserve Bank of India) – Controls money supply, banking system.

- SEBI (Securities and Exchange Board of India) – Regulates stock markets, protects investors.

- IRDAI (Insurance Regulatory Authority) – Oversees insurance companies.

Primary Dealers (PDs)

Primary Dealers (PDs) are RBI-authorized financial institutions that act as market-makers for government securities (bonds). They are like the “official wholesalers” of government debt in India.

Responsibilities

- Must participate in RBI’s bond auctions (cannot skip!)

- Quote daily buy/sell prices for govt. bonds

- Underwrite new bond issues (promise to buy unsold bonds)

- Educate investors about bond markets

- Minimum Net Owned Funds: ₹50 crore

- Must maintain 90% success rate in bond auctions

- Regular reporting to RBI

Structure of Banks in India

Banks in India form the backbone of our financial system. They help people save money, get loans, and make payments safely. The banking structure is well-organized, with different types of banks serving different needs.

Commercial banks, co-operative banks, development banks, regional rural banks, payment banks, small finance banks, and local area banks are the different types of banks in India. Commercial banks are divided into three categories: public, private, and foreign banks (operating in India). For all of these banks to open and operate branches in India, they must first obtain a license from the Reserve Bank of India. All banks must comply with RBI regulations on an ongoing basis after they begin operations.

Let’s break it down in an easy-to-understand way.

1. Scheduled Banks vs. Non-Scheduled Banks

Scheduled Banks and Non-scheduled Banks are the two types of banks that operate in India. A scheduled bank is listed in the 2nd schedule of the RBI Act. It is required to adhere to certain reserve requirements, such as the Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR), regarding its Net Demand and Time Liabilities (NDTL), such as deposits, submission of specified periodic returns, and maintenance of specified books of account. They can also borrow money from the RBI in certain instances.

A. Scheduled Banks

- Listed under the Second Schedule of the RBI Act, 1934.

- Must have a minimum capital of ₹5 lakhs.

- Eligible for loans from the RBI at the bank rate.

- Includes all major commercial banks (public, private, foreign).

B. Non-Scheduled Banks

- Not listed in the RBI’s Second Schedule.

- Have fewer privileges (can’t borrow from RBI easily).

- Mostly local or cooperative banks.

2. Types of Banks in India

A. Commercial Banks (Profit-Based)

These are the most common banks we interact with daily.

- Public Sector Banks (PSBs)

- Owned by the government (more than 50% stake).

- Serve the general public with affordable services.

- Examples: State Bank of India (SBI), Punjab National Bank (PNB), Bank of Baroda.

- Private Sector Banks

- Owned by private companies or individuals.

- Focus on customer service and technology.

- Examples: HDFC Bank, ICICI Bank, Axis Bank.

- Foreign Banks

- Headquartered outside India but operate here.

- Serve high-net-worth individuals and businesses.

- Examples: Citibank, HSBC, Standard Chartered.

B. Small Finance Banks

Small Finance Banks (SFBs) are special banks created to serve small businesses, low-income groups, and people who don’t normally use regular banks. They’re like friendly neighborhood banks that focus on financial inclusion. Small finance banks are a subset of niche financial institutions. Small Finance Banks can offer basic banking services such as deposit acceptance and lending. They must meet the banking demands of the populace, which previously had no access to banking. Furthermore, they must have a minimum of Rs. 100 crore in capital.

Who Small Finance Banks Serve: Small shopkeepers, Street vendors, Small farmer, Micro and small businesses, Low-income families, etc.

What Small Finance Banks Offer: Basic savings accounts, Small loans (microloans), Payment services, Insurance products, etc.

Functions:

- Aim to provide banking services to small businesses, farmers, and low-income groups.

- Can lend but with restrictions.

- Examples: AU Small Finance Bank, Ujjivan Small Finance Bank.

C. Payments Banks

Payment banks and small finance banks are two new types of banks that have lately entered the market. While payment banks are not permitted to provide loans, only they are permitted to accept deposits. They can make deposits of up to one lakh rupees. Their primary role is to collect and settle debts.

- Can accept deposits (up to ₹2 lakh per customer) but cannot give loans.

- Focus on digital payments and remittances.

- Offer savings/current accounts

- Enable digital payments (UPI, mobile banking)

- Issue debit cards (ATM cards)

- Pay interest on deposits (like normal banks)

- Can not issue credit cards

- Can not open NRI accounts

- Examples: Paytm Payments Bank, Airtel Payments Bank, Jio Payments Bank.

D. Cooperative Banks (Community-Based)

Cooperative banks are special banks run by people, for people. They’re like financial self-help groups where members pool their money to help each other with loans and savings. These banks focus on serving local communities rather than making big profits.

- Run by members for their own benefit (farmers, small traders).

- Types:

- . Urban Cooperative Banks (UCBs): They operate in cities and towns, and serve small traders, shopkeepers, and salaried workers. Example: Saraswat Cooperative Bank

- 2. Rural Cooperative Banks: They work in villages to support farmers and agriculture. It has three levels: State Cooperative Banks (at state level), District Central Cooperative Banks (at district level) and Primary Agricultural Credit Societies (village level).

- Functions

- Keep money circulating in local communities

- Offer lower interest rates than money lenders

- Promote financial inclusion in remote areas

- Help farmers get loans when big banks refuse

Co-operative banks can also be divided into two categories: urban co-operative banks and others. Urban Co-operative Banks are controlled by both the state government and the Reserve Bank of India. NABARD, on behalf of the RBI and the respective state governments, supervises other cooperative banks. Multi-state cooperative banks, on the other hand, are subject to both the Central Government and the RBI’s jurisdiction.

E. Regional Rural Banks (RRBs)

RRBs are special banks created to serve India’s rural areas and agriculture sector. They’re like “local banks for villages” – smaller than national banks but more powerful than cooperative banks.

Ownership Structure: 50% by Central Govt, 35% by Sponsor Bank (like SBI, PNB etc.), 5% by State Govt.

Functions:

- Set up to provide banking in rural areas.

- They Offer Crop loans, Kisan Credit Cards. Micro-loans for small businesses. Basic savings accounts.

- Jointly owned by the central govt., state govt., and a sponsor bank.

- Examples: Andhra Pradesh Grameena Vikas Bank, Uttar Bihar Gramin Bank.

3. Reserve Bank of India (RBI) – The Boss of Banks

The Reserve Bank of India (RBI) is India’s central bank – the “boss of all banks.” It controls the country’s money, banking system, and economy. Think of it as the financial guardian of India.

Key Roles of RBI

1. Issues Currency

- Only RBI can print rupee notes (except ₹1 notes, which are issued by the Govt.)

- Manages coins (but coins are minted by the Govt.)

- Decides how much money should flow in the economy.

2. Banker to the Government

- Manages the government’s bank accounts.

- Helps the Govt. raise money (through bonds, securities).

- Advises on financial policies.

3. Banker to Banks

- All banks (SBI, HDFC, etc.) must keep a part of their deposits with RBI (CRR & SLR).

- Acts as a lender of last resort (gives emergency loans to banks).

4. Controls Inflation & Growth

- Uses tools like Repo Rate, Reverse Repo Rate to control inflation.

- Makes loans cheaper (cuts rates) to boost growth or hikes rates to control price rise.

5. Regulates Banks & Financial System

- Licenses new banks.

- Supervises banks to prevent frauds/crises.

- Protects depositors’ money (DICGC insurance up to ₹5 lakh).

6. Manages Foreign Exchange (Forex)

- Maintains India’s foreign currency reserves (USD, Euro, etc.).

- Stabilizes the rupee’s value against the dollar.

7. Promotes Digital Payments

- Regulates UPI, digital wallets (Paytm, PhonePe).

- Introduced UPI, RTGS, NEFT, IMPS for easy money transfers.

4. Specialized Banks

Specialized banks are unique banks that focus on specific sectors like agriculture, exports, or housing. Unlike regular banks (SBI, HDFC), they don’t serve everyone—just their target industries.

Types of Specialized Banks in India

1. NABARD (National Bank for Agriculture & Rural Development)

- Supports farmers, rural development, and agri-businesses.

- Started in 1982 to boost farming after the Green Revolution.

- Functions:

- Refinances loans for agriculture.

- Funds rural infrastructure (roads, irrigation).

- Helps Self-Help Groups (SHGs).

2. SIDBI (Small Industries Development Bank of India)

- Helps MSMEs (Micro, Small & Medium Enterprises).

- Known as the “MSME Bank.”

- Functions:

- Gives loans to small businesses.

- Supports startups and innovation.

- Refinances loans via banks/NBFCs.

3. EXIM Bank (Export-Import Bank of India)

- Fund exporters & importers.

- Works under the Ministry of Commerce.

- Functions:

- Gives loans to Indian companies selling abroad.

- Insures against foreign payment risks.

- Helps with overseas projects.

4. NHB (National Housing Bank)

- Supports affordable housing.

- Owned by RBI (but works independently).

- Functions:

- Refinances home loans for banks/HFCs.

- Regulates Housing Finance Companies (HFCs).

- Promotes rural housing schemes.

5. MUDRA Bank (Pradhan Mantri MUDRA Yojana)

- Funds small entrepreneurs & street vendors.

- Not a separate bank—it’s a scheme under SIDBI.

- Functions:

- Offers loans under Shishu (up to ₹50k), Kishore (₹50k–5L), Tarun (₹5L–10L) categories.

- Works via banks/NBFCs.

5. Digital Banking & Fintech

- Many banks now offer mobile banking, UPI, and online loans.

- Fintech companies (like PhonePe, Google Pay) work with banks for digital payments.

Final Thought

India’s banking system is diverse, serving everyone from farmers to big businesses. Whether it’s a nationalized bank like SBI or a small finance bank, each plays a crucial role in economic growth.